Each year around this time, I take a snapshot of what properties cost around the world.

To be honest, I do this mostly for my own convenience, so I can use it as a reference—one that’s consistent from one city to the next—while preparing event presentations and researching articles.

But the survey is also full of surprises… things I’d missed during the course of the year.

I’ll see countries where prices are rapidly appreciating… or collapsing. I’ll find new bargains emerging, and old bargain markets that are now getting too expensive to make the numbers work.

It’s an exercise that I look forward to performing each year.

Why Prices Can Move Unexpectedly

Sometimes a spike in the average price does not really paint a true picture of what’s going on. For example, a price change can be a matter of changing inventory. If a new, high-end condo project comes online, it can pull the averages up… just like a budget project can pull them down.

More commonly, a swing in prices (in dollar terms) will mean a change in the local currency’s exchange rate with the dollar. I’ll highlight a few of those below. When the dollar gets stronger (as it’s doing now), properties priced in other currencies get cheaper.

But regardless of the reason, a swing in prices should (and does) raise a flag. Whether it’s actual appreciation or depreciation, the currency, or a major change in inventory, it should be analyzed for opportunity.

Three Markets That Caught My Attention

I started off by looking at the least expensive markets in the survey. Here are a few that grabbed my attention this year… for different reasons.

Granada, Nicaragua

Cost per square meter: US$1,007

Price change this year: Steady

Property trades in: U.S. dollars

One of my favorite cities in the Americas, this city is one of the best places in Latin America to buy a classic, Spanish colonial home… the type of city home built around a central courtyard. Not only are these homes beautiful and inexpensive in Granada, they’re also of a manageable size… unlike their giant counterparts found in many Spanish colonial cities.

Another unusual feature is that many colonials in Granada have pools in the central courtyard.

Property prices have remained fairly steady this year, after dropping more than 15% last year. Granada came in almost exactly at US$1,000 per square meter.

I toured one colonial for sale that had two huge bedrooms, three baths, and about 270 meters of living space. The kitchen, dining room, and living area surround a sparkling courtyard pool. The asking price is only US$119,000.

El Rodadero, Santa Marta, Colombia

Cost per square meter: US$1,064

Price change this year: Slightly negative

Property trades in: Colombian pesos

When I first visited Santa Marta, it was definitely a “work in progress,” but today’s Santa Marta is a different story. The downtown now has an attractive seafront park, plenty of small cafés and bars, as well as coffee shops, boutique hotels, excellent seafood restaurants, and even a cruise ship port. The 256-slip marina draws boaters from around the hemisphere.

Of the half-dozen districts in the greater Santa Marta area, I like El Rodadero best because it’s walkable, inexpensive, and lots of fun.

Property prices in El Rodadero dropped by 16% this year in dollar terms, but on further analysis, I saw this was entirely due to an increase of 18.5% in the U.S. dollar’s buying power. In peso terms, prices in Santa Marta actually went up.

I found a brand-new beachfront apartment for just US$175,500, at today’s exchange rate. It had two bedrooms, two baths, and an area of 106 square meters. If you go back about four blocks from the beach, you can get a larger apartment (117 square meters, four bedrooms, ocean view) for US$111,500.

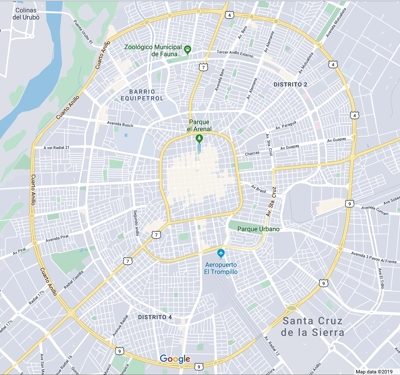

Santa Cruz, Bolivia

Cost per square meter: US$1,283

Price change this year: Slightly positive

Property trades in: U.S. dollars

This is a market that warrants my attention, based on trends over the past few years. Not only is Santa Cruz one of the cheapest major markets in Latin America at US$1,283 per meter, but it also posted one of the most solid gains (again) this year at 11.2%.

Like Granada, Santa Cruz is a Spanish colonial city, founded in 1561. But frankly, if all you want is a Spanish colonial lifestyle, there are dozens of options in the Americas that are more convenient than Santa Cruz, which lies seven hours from Miami.

But for an investment, I like it for a few reasons.

- Bolivian cities like Sucre or La Paz are most popular in the guidebooks, being colorful and attractive to the traveler. But Santa Cruz is the center of Bolivia’s wealth.

- Santa Cruz is one of the world’s fastest-growing cities, producing about one-third of Bolivia’s GDP and receiving most of Bolivia’s Foreign Direct Investment. The population doubles every 15 years.

- Santa Cruz is good for geopolitical and economic diversification, since it is well outside the U.S. sphere of influence. This will help to hedge against the next American recession or economic downturn and provide isolation against political turmoil.

- Properties in Santa Cruz are priced in U.S. dollars, so you won’t be exposed to exchange rate volatility.

I found dozens of good rental prospects in this area, but one that especially caught my eye was a two-bedroom unit of 65 square meters. It’s brand new (still under construction), perfectly located, and selling for just US$70,150… with US$10,000 off for cash up front. If you’d rather not take on the construction risk, there’s a similar apartment nearby for US$80,000.

More Notable Areas In The Survey This Year

Arequipa, Peru dropped in price this year, falling to US$1,124 per meter. This clean, sun-drenched, “eternal spring” city continues to be one of my favorite lifestyle buys for the money.

Cuenca, Ecuador rebounded this year, with the average apartment going up to US$1,456 per meter. It’s still a bargain, but it looks to me like the Cuenca market woke up after a few years of stagnation.

Luxury apartments in Fortaleza, my favorite city in Brazil, are still sitting at 2017 levels, priced at US$1,649 per meter. This price is due to today’s favorable (and temporary) exchange rate.

Mazatlán, Mexico is one of today’s best buys for beachfront property, with averages at less than half the price of the more popular Puerto Vallarta.

How About The Most Expensive Markets?

Paris, France

Paris, France take the prize for the most expensive market in the survey, at almost US$17,000 per meter for a two-bedroom unit in the 5th arrondissement. My managing editor described the 5th as “affordable,” which tells me some neighborhoods are even higher.

Valletta, Malta

Valletta, Malta came in second at US$6,140 per meter.

Puerto Vallarta, Mexico

One surprise was in Puerto Vallarta, Mexico, at US$3,750 per meter, for non-beachfront properties in good areas. But don’t let the high price scare you… PV is still one of the best-producing rental markets you’ll find.

Other markets at the high end were Buenos Aires (US$3,404), Punta del Este, Uruguay (US$3,401), Santiago, Chile (Providencia, US$3,282), and Ambergris Caye, Belize (US$3,177).

Applying My 2019 Property Snapshot

I like zeroing in on inexpensive properties. With a limited budget, you can achieve more diversity if you spend less in each market.

But remember that a low price-tag has nothing to do with the quality of the investment. For example, one of the highest returns I’ve seen lately is in Puerto Vallarta, Mexico… which is relatively expensive.

The best way to use these surveys is not to find the cheapest property… but rather to raise the flag on market changes, so they can be further analyzed.

Lee Harrison